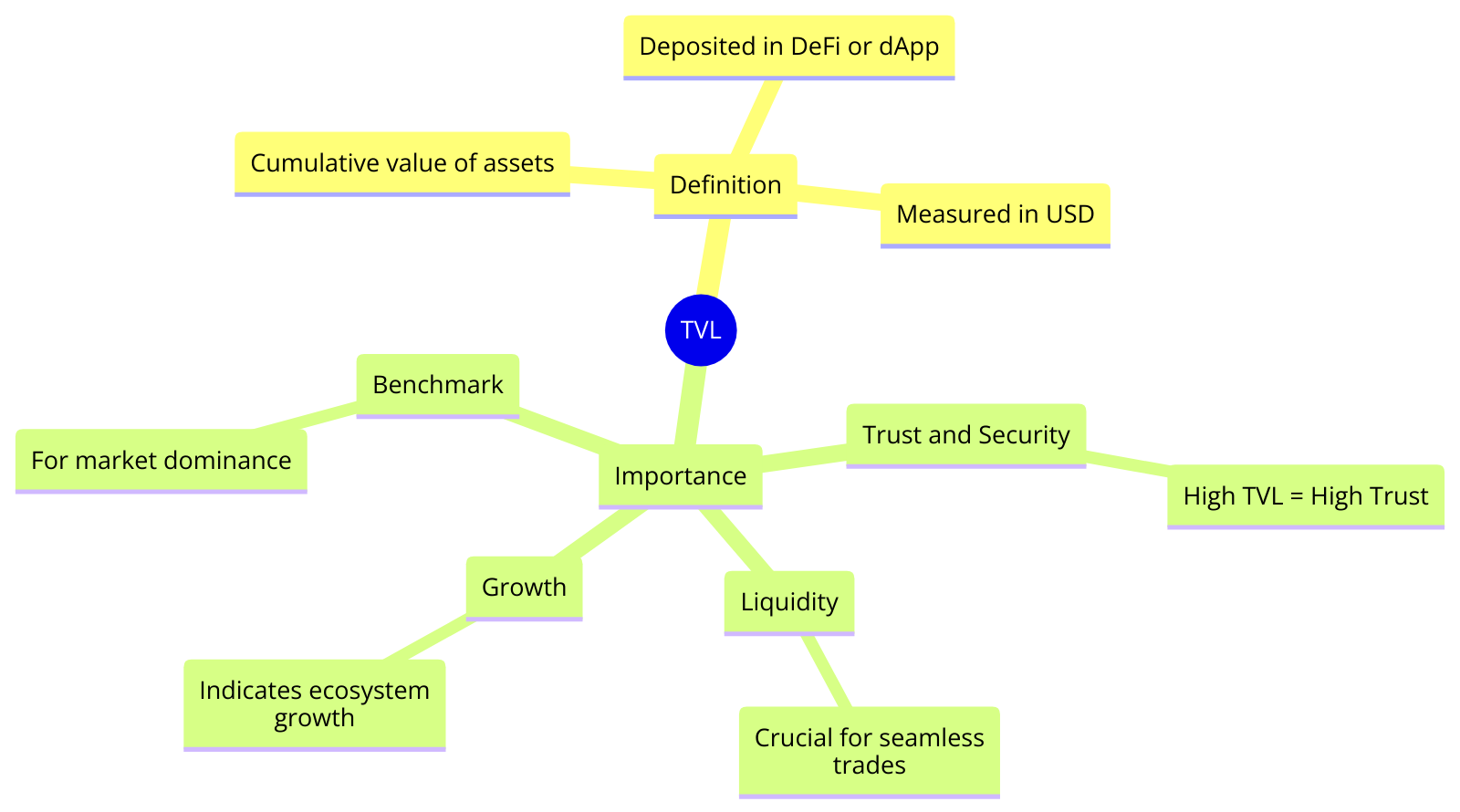

In decentralized finance (DeFi) and decentralized applications (dApps), Total Value Locked (TVL) stands out as a pivotal metric for gauging platform strength and user trust. But what exactly does TVL entail, and why is it considered such an essential indicator in the DeFi ecosystem? This post will dive into the concept of TVL, its implications, and its importance for investors and participants in the decentralized space.

What is Total Value Locked (TVL)?

Total Value Locked represents the cumulative value of all digital assets deposited in a DeFi platform or dApp, whether through staking, liquidity provision, or other forms of participation that require locking assets within the ecosystem. TVL is typically measured in a standard currency like USD to provide a uniform assessment of assets across different cryptocurrencies.

Why TVL Matters

- Trust and Security Indicator: A higher TVL suggests that a substantial number of users trust the platform with their assets, implying a level of security and reliability.

- Measure of Liquidity: TVL is directly related to the liquidity available on DeFi platforms, crucial for the seamless execution of trades and other financial operations without significant price impact.

- Growth and Popularity: An increasing TVL indicates growing interest and engagement with the platform, signaling healthy ecosystem growth and the potential for sustained user activity.

- Comparison Benchmark: Investors and users utilize TVL as a benchmark for comparing the size and market dominance of various DeFi platforms and dApps, aiding in investment decisions.

Calculating TVL

The calculation of TVL involves aggregating the total value of assets locked across all contracts associated with a DeFi platform or dApp, converted into a common currency (usually USD). This includes all forms of locked assets, such as those in liquidity pools, staking contracts, and any other mechanisms requiring users to deposit or lock up their tokens.

Examples and Applications

Consider a DeFi lending platform where users can deposit cryptocurrencies to earn interest or take out loans. The TVL of this platform would include all cryptocurrencies deposited by users, providing a snapshot of the platform's total assets under management.

Similarly, in a decentralized exchange (DEX), TVL encompasses the total value of all liquidity pool tokens—representative of users' contributions to liquidity pools, enabling token swaps on the platform.

TVL's Limitations

While TVL is a valuable metric, it's not without its limitations. It doesn't account for the platform's risk profile, the distribution of locked assets (potential centralization issues), or the platform's efficiency and return on locked capital. Therefore, while TVL is an important metric, it should be considered alongside other factors for a comprehensive evaluation of a DeFi platform or dApp.

The Significance of TVL in DeFi's Landscape

Total Value Locked serves as a crucial barometer for the health and appeal of DeFi platforms and dApps, offering insights into their trustworthiness, liquidity, and user engagement. As the DeFi and dApp landscapes continue to mature, understanding and monitoring TVL will remain essential for participants seeking to navigate this dynamic and innovative space effectively.

Join the Colony Community

Stay connected and dive deeper into the world of on-chain organizations with Colony. For the latest updates, insights, and discussions, follow us on our community channels:

- Website: Visit our website

- Twitter: Follow us on Twitter

- Discord: Join our Discord community

- Github: Find Colony on Github

Together, let's build the future of decentralized collaboration.