Managing Finances in On-Chain Organizations

No matter what kind of organization you’re building, when work gets done, someone needs to get paid. For many businesses, finances are centrally managed. Payments are handled with business banking accounts, and overseen by a finance officer or accounting department.

Traditional finance can be a constraint for many DAOs and on-chain organizations. Funneling financial authority through a centralized authority goes against the principles of decentralization and Web3. Internet native organizations require financial tools that provide more ownership for their members than traditional accounting departments. That’s why many internet native organizations turn to on-chain treasuries as a way to manage their finances.

Treasuries have become a central component of the functionality and sustainability of decentralized organizations. But what exactly is a treasury in the context of DAOs, and why is it so important?

In this piece, we will explore what is a treasury, how they are managed, and what they are used for.

Understanding DAO Treasuries

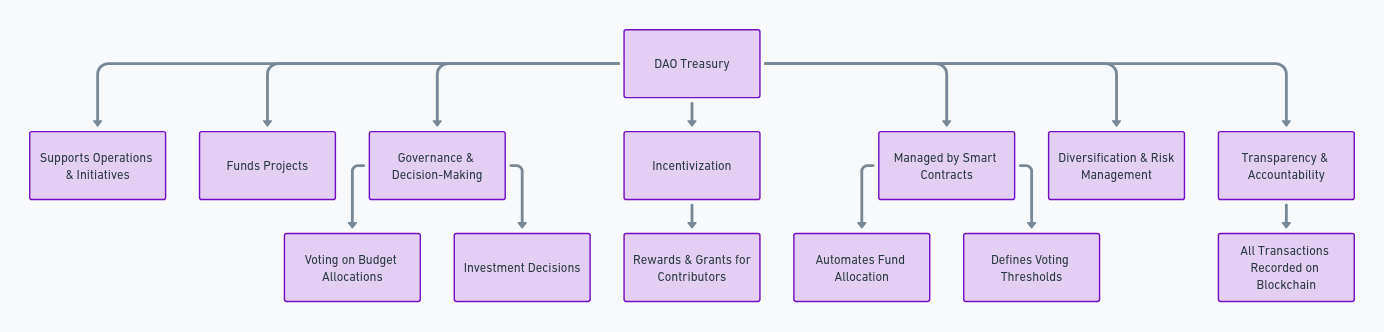

A treasury refers to the collective pool of funds or assets managed by the organization's members. A DAO’s treasury is most often managed through smart contracts and decentralized governance protocols, however this is not always the case. This treasury serves as the financial backbone of the DAO, supporting its operations, initiatives, and long-term objectives.

Where are assets stored?

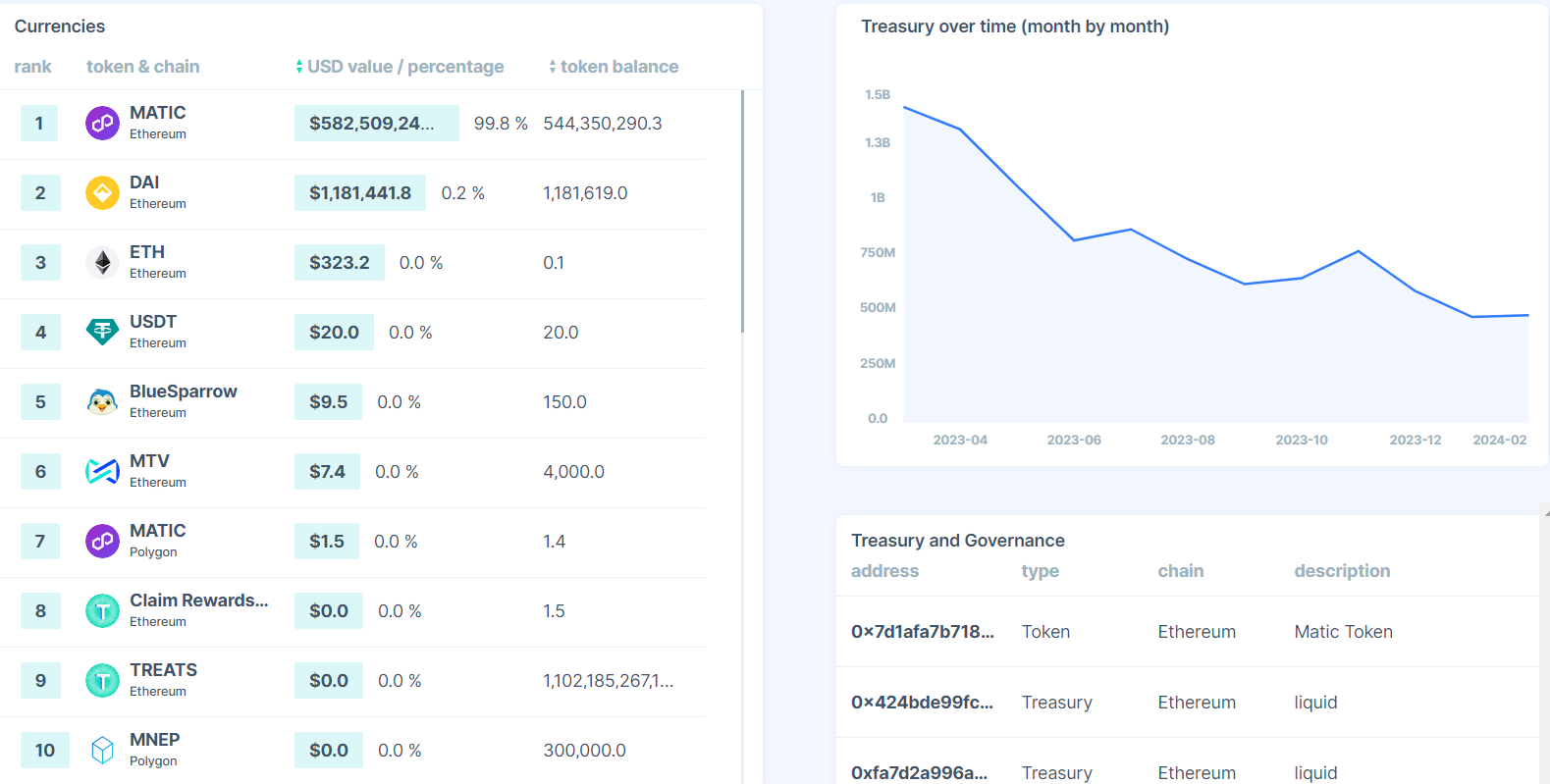

The core assets of a DAO's treasury are most often stored on the blockchain in the form of cryptocurrencies and tokens. Treasury holdings on public chains can be explored using blockchain explorer tools, such as DeepDAO. You can consider a treasury as the DAO’s “wallet”. You can see the size and distribution of the DAO’s treasury holdings, and the tokens within. If you're using Colony to manage your DAO's treasury, you can see your DAO's assets and manage it directly in the interface.

DAO treasuries can also include off-chain assets. These may include fiat currencies and other non-crypto investments, managed through traditional financial systems as well as other investments, including property, non-NFT art, and commodities.

How to read a DAO treasury

Treasuries can provide considerable insight into a DAO’s operations and financial wellness. From their wallet address, anyone should be able to see the different types of tokens held in the treasury and their respective value. You can also see the changes in the treasury over time, which can provide a great depth of insight into understanding a DAO’s operations.

Taking a closer look at the wallet addresses associated with a treasury, you can identify the different types of activities the DAO has been participating or investing in. Watchers can analyze the financial transactions in a treasury to better understand how the DAO or organization spends, or earns money. By following certain wallet transactions, you can see how individual wallets may participate in different projects for the DAO.

It's important to remember that not all of a DAO's treasury assets may be held on chain, or will be visible to public explorers. Be sure to do your own due diligence and research to verify the addresses you are using to analyze treasury holdings, especially when using third party explorers.

Managing a DAO treasury

On-chain organizations use smart contracts to automate the management and operation of their treasuries. These contracts define the rules for fund allocation, voting thresholds, and other governance mechanisms, ensuring transparency and security over the organizations finances.

Effective treasury management often involves diversifying assets to manage risk. DAOs might hold a mix of cryptocurrencies, stablecoins, and potentially even non-crypto assets to safeguard against market volatility. This diversification strategy can extend to include fiat currencies, enabling a more robust approach to treasury management that accommodates a wider range of financial activities and goals.

One of the defining features of DAO treasuries is their transparency. All transactions are recorded on the blockchain, allowing members to track how funds are being used, fostering a culture of accountability. For assets held off the blockchain, DAOs may implement additional reporting and auditing mechanisms to maintain this level of transparency and trust.

What a Treasury is used for

The visibility and openness of a DAO’s treasury helps to align members and coordinate action around how financial resources are deployed.

Funding Projects and Operations

The primary use of a DAO's treasury is to finance projects, operations, and activities that align with the organization's goals. This could range from development work, marketing efforts, community events, to grants and bounties for contributors.

Governance and Decision-Making

DAO treasuries are governed democratically, with token holders typically having a say in how funds are allocated. Voting mechanisms are employed to decide on budget allocations, investments, and other financial decisions, ensuring that members have a direct impact on the DAO's financial direction. Collectively manage organizational finances: Treasuries also allow members with appropriate permissions to manage payments independently of a central authority, letting the organization make decisions efficiently

Incentivization and Risk Management

Treasuries also play a crucial role in incentivizing participation and contribution within the DAO. Rewards, grants, and other financial incentives are distributed from the treasury to active community members, developers, and other contributors, fostering a vibrant and engaged ecosystem. Diversified token holdings in a treasury can be used to grow cash reserves for the DAO, and insulate them from risk due to fluctuating token prices.

Recruitment and Trust Building

The transparency of treasuries helps to align objectives in a decentralized organization, building trust amongst members. This openness can also serve as a recruitment tool for new contributors. Contributors can easily see how the DAO has managed contributor payments in the past, helping to earn trust for those who may be wary to join a Web3 project.

Challenges and Considerations

While DAO treasuries offer a revolutionary approach to organizational finance, they are not without challenges. Regulatory uncertainty, security risks associated with smart contracts, and the complexities of managing a decentralized fund are significant considerations. Moreover, the democratic process of decision-making, while empowering, can sometimes lead to inefficiencies or disagreements within the community.

Conclusion

The treasury of a DAO is much more than just a pool of funds; it is the financial heart of the organization, supporting its activities, enabling growth, and ensuring sustainability. As DAOs continue to evolve and mature, the strategies for managing treasuries will undoubtedly become more sophisticated, reflecting the dynamic and innovative spirit of the blockchain and crypto world. The success of a DAO often hinges on the effective management of its treasury, highlighting the importance of strategic financial planning and community engagement in the decentralized ecosystem.